dependent care fsa coverage

You may contribute up to 5000 per householdper plan year. Child care expenses for children under the age of 13 or 14 depending on your plan.

Enrollment Information 24hourflex

This savings account is great for families who know how much they are going to spend on child care or other dependent costs for the year.

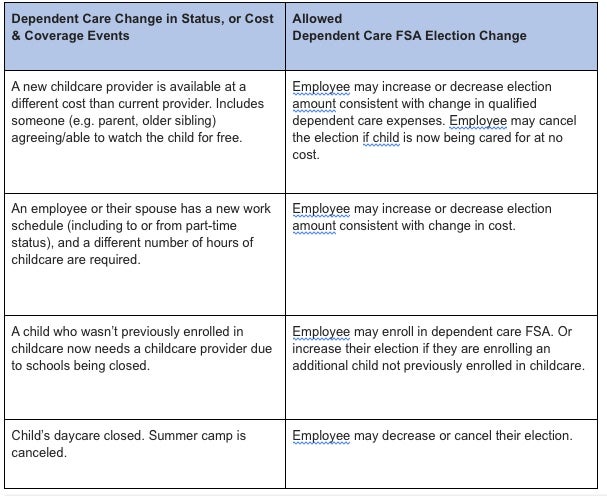

. Unlike the FSA dependent care elections can be changed throughout the plan year without qualifying events. Your account is funded by payroll deductions before taxes. 16 rows You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services.

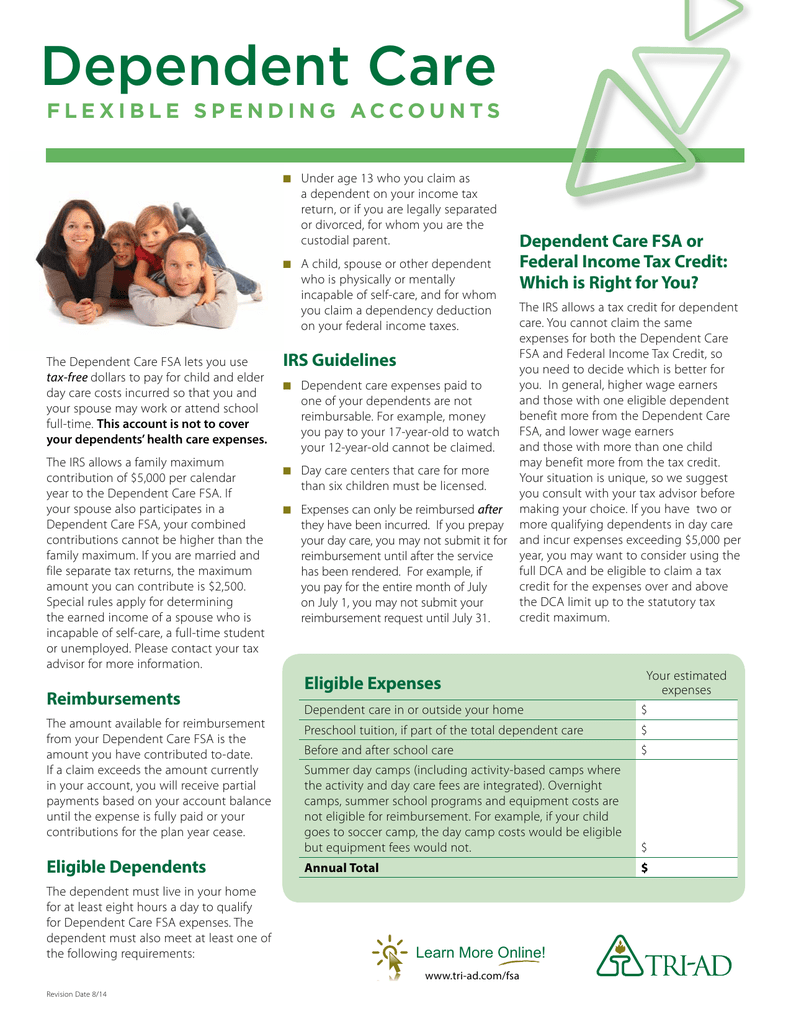

To qualify as an eligible expense the babysitters services must. A dependent care flexible spending account FSA can help you put aside dollars income tax-free for the care of children under 13 or for dependent adults who cant care for themselves. The employees dependent child who is under age 13 when the care is provided.

The employees employment-related dependent care expenses must be for a qualifying individual to be reimbursable under the dependent care FSA. Adult daycare for parentsrelatives who you declare as a dependent for tax purposes are also eligible for the 5000 deduction. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend school full-time.

Your children under age 13 or over age 13 with disabilities. Licensed day care centers. The Dependent Care Federal Savings Account FSA is an account where you can put aside tax-free dollars that you can later use on expenses for your dependent.

ARPA increased the dependent care FSA limit for calendar year 2021 to 10500. Dependent Care FSA Increase Guidance. The most common FSA is the HealthCare FSA HCFSA that covers common medical procedures co-payments prescription drugs and over-the-counter products.

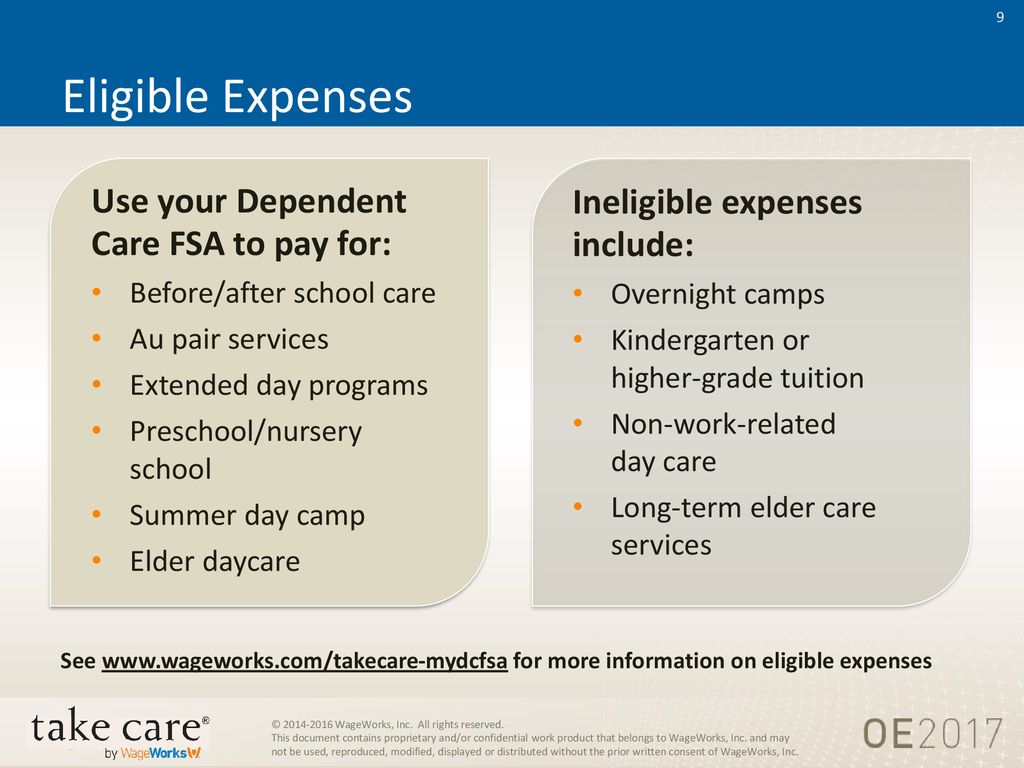

Provides flexibility for a special claims period and carryover rule for dependent care assistance programs when a dependent ages out during the COVID-19 public health emergency. Allows certain mid-year election changes for health FSAs and dependent care assistance programs for plan years ending in 2021. That money may help pay for a variety of eligible services including day care nursery school preschool after-school or senior day care.

An FSA is not a savings account. The IRS determines which expenses can be reimbursed by an FSA. Nursery schools or pre-schools.

Get a free demo. Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Zero Guesswork When You Shop 6000 Eligible Items at FSA Store. A dependent care flexible spending account DCFSA can help you put aside dollars income tax-free for the care of children under the age of 13 or for dependent adults who cant care for themselves.

Set aside Pre-Tax dollars to use for Child Care and Adult Day Care expenses. Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. A Dependent Care Flexible Spending Account DC-FSA covers qualified daycare expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves.

Dependent Day Care Flexible Spending Account. A Dependent Care FSA can cover expenses paid to a babysitter under the age of 19 as long as they are not your or your spouses child stepchild foster child or tax dependent. Select your contribution each year.

Be sure to check with your tax advisor if you have questions about whether. However it cant exceed the IRS limit 2750 in 2021. Contact a Corporate Coverage benefit design consultant to see how we can make this benefit work for you.

The minimum is 120 per plan year and the maximum is 5000 per plan year. How a dependent care FSA works. However if you did not find a job and have no earned income for the year your dependent care costs are not eligible.

Allow unused funds remaining in a health or dependent care FSA at the end of a grace period or plan year ending in 2020 to be used to pay or reimburse expenses incurred. ARPA Dependent Care FSA Increase Overview. However parents and caretakers may also consider the Dependent Care FSA DCFSA which covers childcare and and maybe even care for family members who are incapable of self-care.

A qualifying individual is. Allow employees to establish revoke or modify health or dependent care FSA contributions mid-plan year on a prospective basis during calendar year 2020 and 2. While this list shows the eligibility of some of the most common dependent care expenses its not meant to be comprehensive.

Check your plan for specific coverage details. A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves. Your account is funded by payroll deductions before taxes.

Employers set the maximum amount that you can contribute. The care of a spouse or dependent of any age who is physically or mentally incapable of self-care and is a tax dependent or. ARPA automatically sunsets the increased dependent care FSA limit at the.

With a dependent care FSA you can use your pretax funds to pay for childcare for dependents age 12 or younger including daycare preschool and summer day camp. Dependents whose day care expenses are eligible for reimbursement under the dependent day care FSA are. Heres how a health and medical expense FSA works.

A Dependent Care FSA DCFSA is a type of flexible spending account that provides tax-free money for. Dependent care FSA-eligible expenses include. Before school or after school care other than tuition Qualifying custodial care for dependent adults.

An FSA is a tool that may help employees manage their health care budget. As with the standard rules the limit is reduced to half of that amount 5250 for married individuals filing separately. Ad Custom benefits solutions for your business needs.

However if you did not find a job and have no earned income for the year your dependent care costs are not eligible. Elevate your health benefits. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend school full-time.

Dependent Care FSA. Easy implementation and comprehensive employee education available 247. You can also pay for adult care for a spouse or dependent who is incapable of self-care including elder care and in.

If you are single or married and file a joint tax return you can deposit up to 5000. Placement fees for a dependent care provider such as an au pair. Anyone you claim as a tax dependent who requires special care including spouses parents or a spouses parents.

Child care at a day camp nursery school or by a private sitter. An example of an adult dependent would be an elderly parent not capable of self-care who has the same principle residence as the employee.

Dependent Care Fsa Flexible Spending Account Ppt Download

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Why You Should Consider A Dependent Care Fsa

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

Flexible Spending Accounts Fsa 2020

How To File A Dependent Care Fsa Claim 24hourflex

How A Dependent Care Fsa Can Enhance Your Benefits Package

Flex Spending Accounts Hshs Benefits

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Dependent Care Flexible Spending Account University Of Colorado

Flexible Spending Accounts Fsa 2020

Dependent Care Fsa Flexible Spending Account Ppt Download

Health Care And Dependent Care Fsas Infographic Optum Financial

What Is A Dependent Care Fsa Wex Inc